Why you need to be in an Index fund

If you are serious about your hard earned savings and you believe the bank is the best and safest place for your money stop reading now!

Leads4biz meets regularly with some of the top Investors and advisors in the region and what comes out is an interesting dialogue:

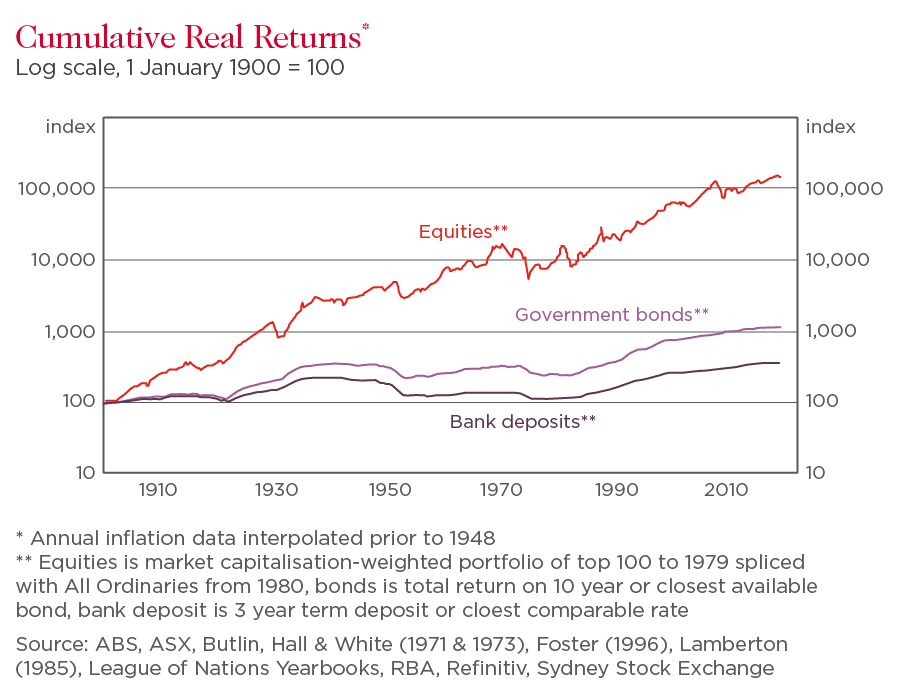

The most popular indexes have proven time and time again over 200 years how your money grows. But the key is patience, if you look on a day to day basis you will be left a gibbering wreck shouting obscenities from a padded room. But the smart money believes in the long haul and a wise spread bet over the top companies.

Looking over the past 200 years it seems that investing in the stock market even cautiously has paid dividends, again when you look at it as a savings vehicle and not an overnight get rich quick scheme. Interesting that Warren Buffet believes in diversification over time:

In 2007, the richest investor on Earth made a $1 million bet against Protégé Partners that hedge funds wouldn’t outperform an S&P index fund, and he won.

Buffett’s choice fund, the Vanguard 500 Index Fund Admiral Shares, returned 7.1 percent compounded annually, while the basket of hedge funds his competitor chose returned an average of only 2.2 percent, the Wall Street Journal reports.

Buffett and Protégé Partners originally put about $320,000 each into bonds that would appreciate to $1 million over the course of their wager, but because the bonds appreciated much faster than expected, they decided to buy 11,200 Berkshire B shares, which are now worth $2.22 million!

Protoge and Buffet decided in the original bet, the money will go to charity that supports young girls in Omaha through after-school and summer programs.

Although there are no guarantees in the stock market, especially over the short term, Buffett’s conviction that index funds are a smart investment is solid advice that almost anyone can follow.

Investing in an index fund is a form of passive investing.

Index funds generally have a lower fee structure than actively managed funds, because they’re not as costly to manage.

Buffett specifically recommends these indexes as a way to boost retirement savings. “Consistently buy an S&P 500 low-cost index fund.

“I think it’s the thing that makes the most sense practically all of the time. “He told CNBC

Simple example of Stocks over time!

Suppose, for example, that a 30-year-old individual has $5,000 invested in equities earning 8% a year, which is a little below historical averages. At the end of the first year, the investor’s portfolio earned $400 in interest ($5,000 x 1.08). If the investor re-invests the interest, the same 8% growth will yield $432 in year two ($5,400 x 1.08). Year three will generate $466.56, year four generates $503.88 and so on. At age 35, the re-invested portfolio is worth $7,346.64, all without any additional non-interest contributions by the investor.

Follow this pattern for another 25 years, and the investment reaches $50,313.28. This represents more than a 10-fold increase, despite a lack of additional contributions.

Follow this pattern for another 25 years, and the investment reaches $50,313.28. This represents more than a 10-fold increase, despite a lack of additional contributions.

Investing $100 Monthly: An Example

Now suppose the same 30-year-old investor finds a way to save an additional $100 per month. He contributes the extra $100 to his portfolio and keeps reinvesting his dividends and interest payments. His investment still earns 8% per year. For simplicity’s sake, assume compounding takes place once per year in January.

After a 30-year period, thanks to compound returns and a small monthly contribution, his portfolio will grow to $186,253.14 (as compared to $50,313.28 without the monthly contributions). While $186,253.14 is not enough money to retire on, especially after 30 years of inflation, remember that this is just with $100 a month in contributions and returns below historical averages.

Suppose the annual return is 9%, which is closer to historical averages for a 30-year period. With a $5,000 principal investment and $100 monthly contributions, the portfolio grows to $229,907.44. If the investor is able to save $200 a month for contributions, the future value of his portfolio is $393,476.48.

Compare the above returns with saving $100 in your bank over 30 years!

The History of the top indexes’ should teach you something!

Some anecdotes we found interesting by observing the results 189 years between 1825 and 2013:

- The market had 134 positive years and 55 negative years (the market was up 71% of the time)

- 44% of the time the market finished the year between 0% and +20%

- 60% of the time the market finished the year between -10% and +20%

- Only 14% of the time (26 out of 189 years) did the market finish worse than -10%

- Only a mere 4.8% of the time (fewer than 1 in 20 years) did the market finish worse than -20%

So to put it another way (using the 189 years between 1825 and 2013 as our sample space), there is an 86% chance that the market finishes the year better than -10%. There is a 95% chance the market ends higher -20%. And as I mentioned above, there is a 71% chance that the market ends any given year in positive territory.

That makes sense for two reasons: Index funds are inexpensive and aren’t tied to the success of one single entity.

“The trick is not to pick the right company,” Buffett says. “The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently.”

Individual stocks also cost more to manage, which means advisors take a larger chunk of your earnings.

Buffett’s not the only business titan to champion index funds. Mark Cuban gave the thumbs up during an interview with Hayman Capital Management founder Kyle Bass,

“If you don’t know too much about markets, the best way to invest your money right now is to put it in a cheap S&P 500 SPX fund.” The self-made billionaire said.

Tony Robbins agrees. “Index funds take a ‘passive’ approach that eliminates risk” in his book Unshakable:

“When you own an index fund, you’re also protected against all the downright dumb, mildly misguided or merely unlucky decisions that active fund managers are liable to make,” Robbins writes.

We have financial planners with access to fantastic savings plans with index options that links the returns to the values of the world’s major stock market indices while protecting the principal at maturity through an offshore Trust structure, which provides asset protection, tax advantages and other estate planning benefits.