Panic selling? The Wealthy think differently.

It might be very tempting to want to sell your stock market investment during periods of significant volatility. However, a new analysis by Bank of America suggests that this may be the worst course of action. Since no one can accurately foresee the markets, several fund managers suffered losses. Some individuals worry, “What if they fall even further?”

Even if nobody can forecast significant occurrences like COVID 19, event risk can be managed once they have occurred. Accordingly, your Fund Manager will already have modified his approach to reduce “event risk” even though the Stock Markets may still decline. Although there is still a chance of a further decline, it should only affect a small portion of the markets.

Investors who panic sell run the danger of not only locking in losses but also missing the market’s greatest days. For you frequently discover that the finest stock market days follow immediately after the worst. Your fund manager employs strategies to profit from upward movement.

As an illustration, consider last month (March 2020). The indices experienced two of its highest daily point advances ever while also posting significant losses on a number of days.

The consequences of missing those big up days are profound.

The Bank of America study found that an investor’s overall returns would only be 91% if they missed the ten best days of each decade since 1930 as opposed to 14,962% if they simply stayed invested the entire period.

Consider this:

Missing even one of the year’s top days reduces returns from 14,962% to 91%. Staying involved despite you inkling to sell out is the best way to ensure that you catch those huge up days.

Investors are advised by experts to resist the urge to timing the market, which may be challenging for even seasoned traders.

Equity funds provided a compound annual growth rate of 18.8% between 2003 and 2019, but investors in these funds only received a return of 12.5%, according to a 16-year research by Axis Mutual Fund.

How come? This is due to the fact that most investors who attempt to time the market make mistakes.

The study also discovered that substantial fund inflows occurred following a stretch of favorable results, not beforehand. We frequently witness this.

Investors who attempt to time the market just make matters worse. It would be better for them to endure it.

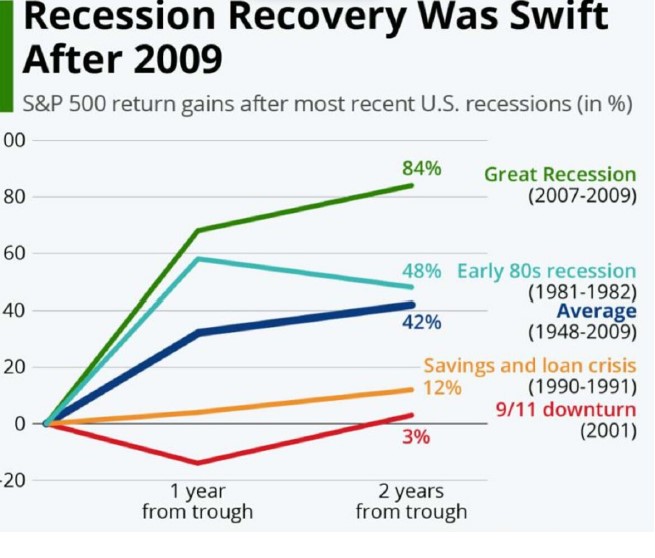

We are aware that it is difficult to watch your investments lose value, but missing the comeback will be even more difficult. We’ll wrap off with a statement made by Warren Buffett in his most recent letter to shareholders.

Tomorrow, anything might happen to stock values. Occasionally, the market will experience significant dips, possibly even 50% or more. But for someone who doesn’t utilize borrowed money and has emotional control, investing in stocks will be a lot better long-term option thanks to The American Tailwind and the compounding miracles Mr. [Edgar Lawrence] Smith mentioned.

In the end, Buffett is recommending to “remain composed and make long-term investments.”

Find a new advisor if your current one permitted you to liquidate your investments without a significant protest. The same holds true for those who now have cash on hand. Find a new advisor if your current one hasn’t urged you to invest it right away. It serves no use to continue working with a consultant or consulting firm that lacks your level of expertise.

Warning: This strategy was NOT written for people who have invested in a few stocks. This blog was written for people who have invested in Mutual Funds and/or those with a diverse investment portfolio of stocks. If in doubt, speak to one of our qualified professionals.