Principles of Investing Pt 1

Welcome to the first instalment of our “Principles of Investing” blog series, tailored for expatriates navigating the intricate world of global finance. Over the next ten weeks, we will unveil key investment principles that form the cornerstone of effective financial management, starting with a concept that influences every investment decision: the risk-reward ratio. This series is designed to equip you with a deep understanding of essential investment dynamics, enabling you to make informed decisions that align with your long-term financial goals.

The Essence of Risk vs. Reward

At the heart of every investment strategy lies the balance between risk and reward. This fundamental principle dictates that the potential for higher returns is generally accompanied by a higher degree of risk. Understanding this balance is crucial, particularly for expatriates, whose financial and personal circumstances span across countries and continents, introducing unique risks and opportunities.

Risk, in its various forms—market risk, credit risk, liquidity risk, and more—needs to be carefully managed to align with one’s financial goals and risk tolerance. For instance, equities often offer higher potential returns but come with increased volatility and risk of loss, especially evident during market downturns like the 2008 financial crisis or the 2020 pandemic-driven market crash.

Market Volatility and Historical Perspectives

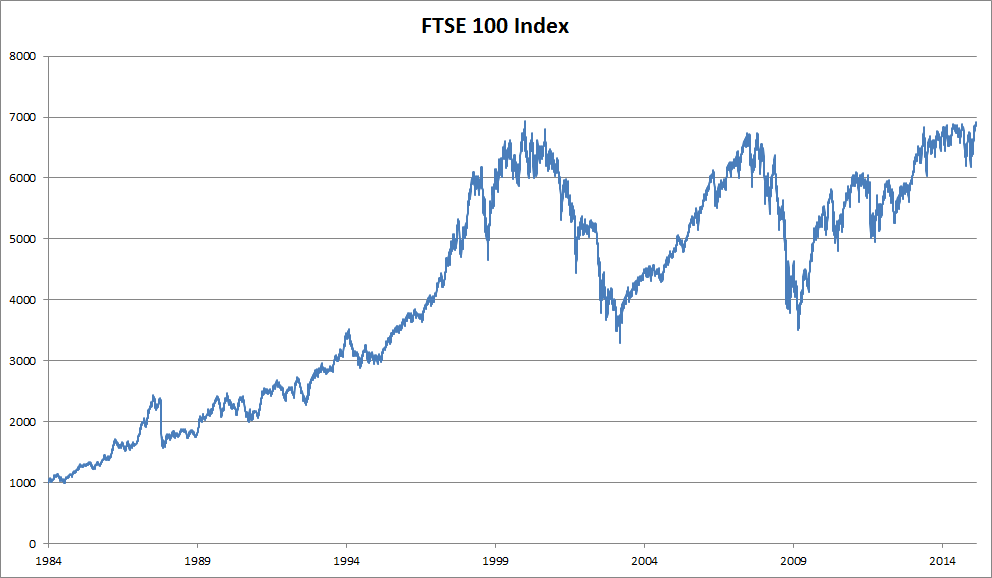

Reflecting on historical data illuminates the stark realities of market volatility. The FTSE 100, which tracks the performance of the UK’s largest 100 companies, and broader indices like the S&P 500 and NASDAQ in the United States, have all experienced significant drawdowns in past financial crises. For example, the S&P 500 saw a maximum drawdown of 55% during the 2008 crisis, while the NASDAQ faced an even more drastic 82% drop during the dot-com bubble burst. These figures serve as a powerful reminder of the risks associated with high equity exposure.

The impact of such drawdowns on a global scale particularly affects expatriates, who might find their retirement savings or investment portfolios severely affected without diversified holdings. The recent global economic turmoil has shown that no market is immune to shocks, which can be exacerbated for those living away from their home countries, dealing with additional challenges such as currency fluctuations and geopolitical risks.

Expatriates and the Unique Challenges of Diversification

For expatriates, the principle of diversification is not just a recommendation—it’s a necessity. Diversifying investments across various asset classes, industries, and geographies can mitigate the risks of significant financial losses. It helps create a buffer against the volatility of any single market or economy. Moreover, the integration of assets like bonds, real estate, or alternative investments can provide stability and income, complementing the growth potential of equities.

Setting the Stage for Informed Investment Decisions

As we continue in this series, we will delve deeper into how these principles apply specifically to expatriates, discussing strategies to manage risks associated with various asset classes, how to adapt investment approaches to different life stages, and the importance of staying informed about global economic developments.

This introductory post sets the stage for a journey through the world of investing, tailored to the unique needs of the expatriate community. By understanding and applying the fundamental principles discussed here, you can prepare yourself to navigate the complexities of the global market with greater confidence and strategic insight.

Stay tuned for our next post, where we will explore the intricacies of asset allocation and how it can be optimised to suit your individual risk tolerance and investment goals. This series promises to be an enlightening path toward achieving financial stability and success, no matter where in the world you find yourself.

Explore Brigantia for more insights and tailored investment advice.

With this solid foundation in understanding risk versus reward, you are better equipped to make investment decisions that can withstand the tests of volatile markets and the complexities of living abroad. Join us as we continue to uncover the principles that will guide your investment strategy towards success.

As we delve deeper into the intricacies of investment strategies for expatriates, it’s crucial to explore the different facets of risk management, diversification, and the practical application of investment theories like Modern Portfolio Theory (MPT) and the Efficient Frontier. These concepts are vital in creating a resilient financial plan that can withstand the ups and downs of global markets.

Modern Portfolio Theory (MPT) and Efficient Frontier

Modern Portfolio Theory, developed by Harry Markowitz in the 1950s, revolutionised the way investors think about risk and return. MPT posits that an investor can achieve optimal portfolio construction by carefully balancing risk and return. This theory introduces the concept of the Efficient Frontier, which represents a set of portfolios that offer the highest expected return for a given level of risk or the lowest risk for a given level of expected return. For expatriates, applying MPT means constructing portfolios that are not only diversified across asset classes but also across different geographic regions and sectors, reducing the exposure to country-specific or region-specific economic downturns.

Implementing Diversification Strategies

Diversification is more than just mixing stocks and bonds; it’s about creating a portfolio where the various investments react differently to the same economic events. This could mean combining US equities with emerging market bonds, real estate investment trusts (REITs) in Asia, or commodities like gold and oil. For expatriates, who might be exposed to currency risks and geopolitical instability, diversification across currencies and asset classes can protect against significant losses in any single area.

The Role of Asset Allocation

Asset allocation is another critical strategy influenced by one’s time horizon, risk tolerance, and investment goals. It involves deciding how to distribute investments among different asset categories. For instance, younger expatriates with a longer time horizon until retirement might lean towards a more aggressive portfolio with a higher concentration of equities. In contrast, those closer to retirement may prefer more bonds and fixed-income assets to preserve capital. Regularly reviewing and rebalancing the asset allocation is essential, especially when economic conditions change or when personal circumstances evolve, such as a change in job, country of residence, or family situation.

Understanding and Managing Risks

Risk management is pivotal in safeguarding your investments. Beyond the basic understanding of market risks, expatriates must consider currency risks, political risks, and inflation risks, especially when living and investing in countries with volatile economic climates. Techniques such as hedging, using derivatives like options and futures, can help manage these risks. Moreover, having an emergency fund in a stable currency can provide a financial buffer against unforeseen personal or economic crises.

Adapting to Global Economic Shifts

Global economic factors such as interest rate changes, trade disputes, or international policy shifts can significantly impact investment portfolios. For expatriates, staying informed and adaptive to these changes is crucial. This might mean shifting investments from one region or sector to another, increasing holdings in more stable investments, or adjusting currency exposures as exchange rates fluctuate.

By understanding and applying these advanced investment principles and strategies, expatriates can better navigate the complexities of investing abroad. The goal is not only to protect assets but to ensure that investment decisions contribute positively to achieving long-term financial goals, regardless of the global economic climate.

As we move forward in this series, we will continue to explore these themes, offering actionable advice and deeper insights into how expatriates can optimise their investment strategies for success in the international arena. Stay tuned for our next discussion on the specific tactics for achieving effective diversification and how to assess the performance of your investment strategies over time.

As we conclude our introductory discussion on the “Principles of Investing” for expatriates, it’s important to reflect on the key insights and prepare for the upcoming topics in this series. Understanding the balance between risk and reward is just the starting point in a sophisticated approach to international investing.

Reflecting on Key Insights

Throughout this discussion, we’ve emphasised the importance of risk management through diversified portfolios, understanding Modern Portfolio Theory, and recognising the significance of asset allocation. These elements are crucial for expatriates who face unique challenges in managing investments across multiple jurisdictions. Implementing these strategies effectively can lead to more resilient portfolios that can withstand the ups and downs of volatile markets.

Looking Ahead

In the coming weeks, we will dive deeper into each principle, exploring topics such as the specific tactics for effective diversification, assessing the performance of your investment strategies over time, and adjusting to life changes that affect your financial planning. Each topic will build on the last, creating a comprehensive understanding of how to manage your investments wisely.

The Role of Continuous Education

Education is a continual process, especially in the dynamic realm of global finance. Staying informed about the latest market developments and economic factors is essential for making informed investment decisions. We encourage you to engage with financial news, seek professional advice, and participate in financial education forums whenever possible.

The Value of Professional Advice

While this series aims to provide valuable insights, the complexity of individual financial situations often necessitates personalised advice. A professional financial advisor can offer tailored strategies that consider your specific goals, risk tolerance, and international lifestyle. They can also help navigate the regulatory environments of different countries, which is invaluable for expatriates.

Invitation to Action

We invite you to visit Brigantia’s website to explore our services further and to schedule a consultation. Whether you are just starting on your investment journey or looking to refine your existing strategies, we are here to assist you in achieving your financial objectives.

Final Thoughts

Investing wisely as an expatriate involves not just understanding the markets but also understanding yourself—your goals, your risk tolerance, and your future aspirations. As you follow along with this series, take the time to reflect on how each principle applies to your personal situation and consider how you might need to adjust your strategies in response to the changing global landscape.

Join us next week as we continue to explore the depth and breadth of investing principles, tailored specifically to the needs of the expatriate community. Your journey to financial clarity and success is just beginning, and we are here to guide you every step of the way.

Explore more and schedule your consultation at Brigantia’s website, and together, let’s build a financial future that’s as robust and adventurous as your expatriate life deserves to be.