“Principles of Investing” Part 2

The Importance of Diversification

Welcome to the second instalment of our “Principles of Investing” series, where we explore the fundamental concept of diversification in investment portfolios. Often hailed as the cornerstone of prudent investing, diversification is akin to not putting all your eggs in one basket. This strategy involves spreading investments across various asset classes, sectors, and geographical locations to mitigate risks and capitalise on different market opportunities. In this post, we’ll delve into why diversification is crucial, how it can safeguard your investments from volatility, and the optimal ways to achieve a diversified portfolio that aligns with your financial goals. Let’s unpack the essentials of diversification and its undeniable role in enhancing the resilience of your investment strategy.

The Fundamentals of Diversification

Diversification is a strategy that involves spreading your investments across various asset classes, sectors, and geographies to minimise the risks associated with market volatility. By investing in a range of assets, you reduce the impact that any single underperforming investment can have on your overall portfolio. The rationale behind diversification is rooted in the idea that different asset types often perform differently under various economic conditions. For instance, while stocks may perform well during economic expansions, bonds often provide stability during downturns, ensuring that your investment risks are balanced, and your portfolio’s performance is steadied. This section explains the mechanics of how diversification works and why it’s a critical component in achieving long-term investment success.

The Benefits of Diversification

Diversification is not just about reducing risk; it’s also about enhancing potential returns across different market environments. By diversifying investments, you can capture gains from a variety of sources, which can help smooth out the overall performance of your portfolio during times when certain asset classes are underperforming.

Reducing Volatility: Diversification helps in reducing the volatility of your portfolio. Since different asset classes respond differently to the same economic events, the poor performance of some investments is often offset by better performance in others. This balance can lead to smoother overall portfolio returns.

Increasing Potential Returns: While diversification is primarily seen as a risk management tool, it also has the potential to increase returns by providing exposure to a variety of asset classes, each with its own growth potential. For example, while stocks may offer high growth potential, bonds can provide regular income, and commodities may serve as a hedge against inflation.

Mitigating Risks of Loss: By spreading investments across a wide array of assets, diversification limits the damage that any single failing investment can inflict on the portfolio. This is especially crucial in avoiding large losses from unforeseeable events that might affect one particular industry or market.

Adaptability to Market Changes: A well-diversified portfolio can adapt to economic changes more flexibly. If one segment of the economy starts to underperform, a diversified portfolio can pivot towards segments that are doing better, thus maintaining its stability and potential for growth.

Through these mechanisms, diversification not only helps protect your investments but also positions them to benefit from multiple sources of potential gains. This strategy is essential for building resilience and achieving consistent long-term financial growth.

Diversification Strategies

Achieving effective diversification involves more than just spreading investments across multiple stocks or bonds. Here we discuss various strategies that can help investors build a robust and diversified investment portfolio:

Asset Allocation: This fundamental strategy involves dividing investments among different asset classes, such as stocks, bonds, real estate, and cash. Each asset class has its own risk and return characteristics, and the allocation should align with the investor’s risk tolerance and investment timeline.

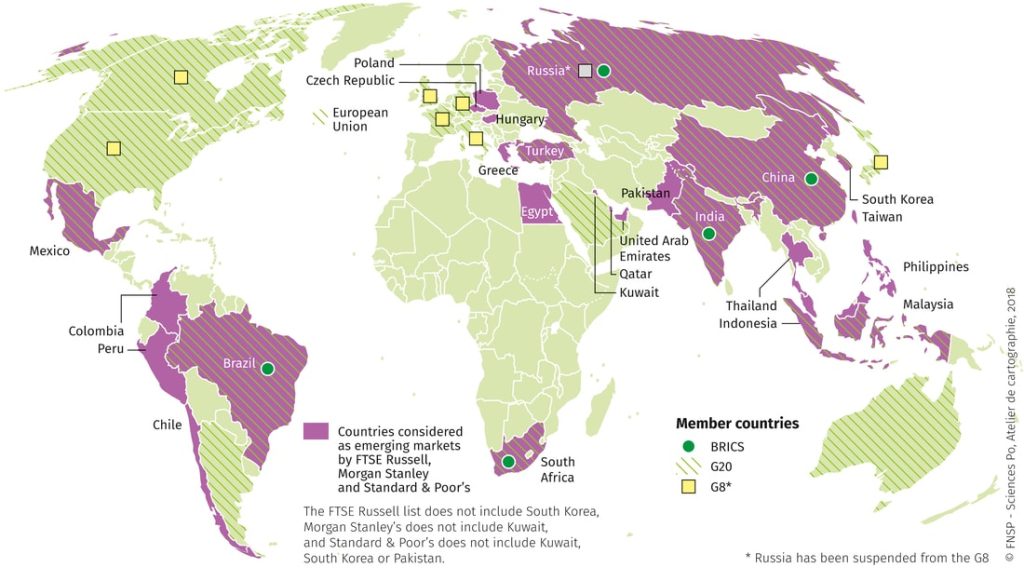

Geographical Diversification: Investing in markets across different countries and regions can reduce risk further. Different markets respond differently to economic events; for example, emerging markets might offer high growth potential but come with higher risk compared to developed markets.

Sector Diversification: Investing across various sectors and industries can safeguard against sector-specific risks. For instance, while technology stocks may suffer during a tech downturn, consumer staples or healthcare stocks may remain stable or even see gains.

Diversification by Investment Style: Combining growth and value investment styles, or blending active and passive management strategies, can also help in reducing risk and taking advantage of different market conditions.

By implementing these diversification strategies, investors can effectively manage risk and position their portfolios to capture opportunities across a broad spectrum of assets, sectors, and geographies. This approach not only minimises potential losses but also contributes to achieving more stable and potentially higher returns over the long term.

Common Misconceptions about Diversification

While diversification is a cornerstone of sound investment strategy, several misconceptions persist that can lead to suboptimal portfolio management. Addressing these myths is crucial for investors to utilise diversification effectively:

Myth 1: More is Always Better

- Simply adding more investments to a portfolio doesn’t necessarily improve its performance. Over-diversification can dilute potential returns and complicate managing the portfolio effectively. The key is to find the right balance that aligns with your investment goals and risk tolerance.

Myth 2: Diversification Eliminates Risk Completely

- It’s important to understand that diversification manages, but does not eliminate, risk. Market-wide downturns can still affect diversified portfolios, though typically to a lesser extent than more concentrated portfolios.

Myth 3: Diversification Only Involves Holding Different Stocks

- Effective diversification extends beyond just mixing stocks. It includes a variety of asset classes, sectors, geographical areas, and investment strategies to buffer against potential market corrections in any one area.

Myth 4: Diversification is Only for Preventing Losses

- While diversification is a defensive tactic to minimise losses, it also plays an offensive role by creating opportunities for enhanced returns. Diversified portfolios can capture gains from high-performing assets which might be missed with a more limited focus.

Myth 5: Once Set, Diversification is Permanent

- A diversification strategy should evolve as market conditions change, personal financial situations shift, and investment goals progress. Regular portfolio reviews and adjustments are essential to maintain effective diversification over time.

By debunking these myths, investors can adopt a more nuanced approach to diversification, optimising their portfolios not only to protect against risks but also to capitalise on potential opportunities across the global financial landscape.

Assessing and Adjusting Your Diversification Strategy

Regular assessment and timely adjustment of your diversification strategy are vital to maintaining the efficacy of your investment portfolio. As markets evolve and personal financial situations change, so too should your approach to diversification.

Evaluating Portfolio Performance

- Periodic review of your portfolio’s performance is essential. This involves not just looking at the overall returns, but also understanding how different segments of the portfolio are contributing to these returns. Such reviews can highlight areas that may require rebalancing or further diversification.

Adjusting to Life Changes

- Significant life events such as marriage, the birth of a child, or retirement can alter financial goals and risk tolerance. Such changes should prompt a reassessment of your investment strategy to ensure that it remains aligned with your new circumstances and goals.

Responding to Market Changes

- Economic and market conditions can change rapidly. Active monitoring of these conditions can help you understand when to adjust your portfolio. For example, if a particular asset class or sector becomes overvalued, it might be wise to reduce exposure to that area to mitigate risk.

Rebalancing for Optimal Allocation

- Rebalancing is the process of realigning the weightings of a portfolio to stay in line with a predetermined asset allocation. It helps in capitalising on the market’s gains while maintaining the desired level of risk exposure by periodically buying or selling assets to match your target asset allocation.

Technological Tools and Expert Advice

- Utilising technological tools for data analysis and portfolio management can provide deeper insights and facilitate timely decisions. Moreover, consulting with financial experts can provide you with informed perspectives and tailored advice, ensuring that your diversification strategy is both robust and dynamic.

By maintaining a proactive approach to reviewing and adjusting your diversification strategy, you can better navigate the complexities of the markets and enhance your portfolio’s potential to meet your long-term financial objectives. Remember, diversification is not a set-it-and-forget-it strategy but a dynamic process that needs continuous attention and refinement.

Conclusion: Embracing Diversification in Investment Strategies

In wrapping up our discussion on the importance of diversification, it’s clear that this strategy is not merely a safeguard but a proactive approach to enhancing and stabilising investment returns. Diversification stands as a testament to the adage, “Do not put all your eggs in one basket,” offering a structured method to manage risk while pursuing growth.

The Continuous Journey of Diversification

- Diversification is an ongoing process that requires continuous assessment and adaptation. As financial markets evolve and your personal financial goals shift, so too must your approach to diversifying your investments. This dynamic strategy ensures that you are well-positioned to respond to economic changes and market opportunities.

The Role of Diversification in Achieving Financial Goals

- Beyond mitigating risks, diversification is crucial for achieving long-term financial goals. It allows investors to explore different sectors and asset classes that could outperform in various market conditions, thus maximising potential returns across the investment spectrum.

Future Outlook on Diversification

- As the global economic landscape grows increasingly complex, the value of diversification will only intensify. Investors who embrace this strategy will benefit from its protective measures during downturns and its potential to capture growth in rising markets.

Final Thoughts and Call to Action

- Whether you are a seasoned investor or just starting out, understanding and implementing a robust diversification strategy is key to maintaining a healthy and productive investment portfolio. We encourage you to continually assess and adjust your investment approach and consider seeking professional advice to ensure your portfolio aligns with your financial aspirations.

As we continue to explore essential investment principles in our series, keep in mind that diversification is not just a tactic but a fundamental component of a sound investment strategy. For those looking to enhance their understanding or review their investment strategies, do not hesitate to reach out for a consultation or visit our website for more insights on building a diversified and resilient portfolio.