Is Bitcoin still a viable Asset?

Welcome to our latest blog post, where we explore Bitcoin as both a paradigm shift in monetary assets and a viable component of modern investment strategies. As the digital age reshapes our financial landscape, Bitcoin emerges as a leading protagonist in the narrative of future currency, challenging traditional concepts and offering new opportunities.

The Genesis of Bitcoin

Bitcoin was created in 2009 by an individual or group under the pseudonym Satoshi Nakamoto. Unlike traditional currencies, Bitcoin operates on a decentralised network using blockchain technology, which ensures transparency and security without the need for a central authority. This revolutionary approach to currency was partly a response to the financial instability observed during the 2008 financial crisis, proposing a system where monetary policies could not be influenced by any government or organisation.

Bitcoin’s Promise

The promise of Bitcoin lies in its potential to serve as a global digital currency that provides stability, efficiency, and reduced transaction costs. It offers a unique set of characteristics including limited supply, divisibility, and portability, which could position it as a viable alternative to traditional fiat currencies in the future.

Setting the Scene for Discussion

This blog will delve into the characteristics of Bitcoin and compare it with historical monetary assets like gold, explore the economic theories that support or criticise its potential, and evaluate its role and performance in diversified investment portfolios. We aim to provide expatriates and global investors with the insights needed to understand Bitcoin’s place in a broader economic context and its practical implications for personal investment strategies.

Join us as we unpack the complexities of Bitcoin and consider its future implications in the world of finance and beyond. This journey promises to enhance your understanding of digital assets and help you make informed decisions about incorporating Bitcoin into your investment portfolio.

Bitcoin and the History of Money

Bitcoin’s emergence is often viewed within the broader context of the history of money, which is a tale of evolution from tangible bartering tools to digital assets. Traditional monetary systems have always been based on the trust and utility that certain assets hold within an economy. Historically, commodities like gold served as money because of their inherent value and relative scarcity.

Evolution from Physical to Digital

As societies advanced, physical money evolved into representative money, which included banknotes backed by a guarantee to exchange them for silver or gold. In the 20th century, the world moved towards fiat currency—money that has value primarily because of government regulation or law and not because of physical backing. The innovation of digital currency, however, represents a significant shift. Unlike fiat currencies, digital currencies like Bitcoin are not issued by any central authority, which is a fundamental departure from traditional money.

Characteristics of Successful Monetary Assets

For an asset to function effectively as money, it must be durable, portable, divisible, uniform, widely accepted, and relatively scarce. Bitcoin meets these criteria in ways that even gold and traditional fiat currencies do not. It is digital, making it highly portable and divisible; blockchain technology ensures uniformity and durability; its cryptographic nature limits supply, ensuring scarcity.

Introduction of Bitcoin as a Monetary Innovation

Bitcoin introduced the concept of decentralised finance using blockchain technology, which records transactions across multiple computers so that the record cannot be altered retroactively without altering all subsequent blocks. This technology not only supports Bitcoin’s role as money but also enhances its security and transparency, characteristics that are essential for trust in any monetary system.

Austrian vs. Keynesian Economic Perspectives

From an economic standpoint, Bitcoin can be analysed through the lens of Austrian economics, which emphasises rigid money supply and the dangers of inflation—concerns that Bitcoin addresses with its capped supply. On the other hand, Keynesian economics, which advocates for active government intervention in the economy, may critique Bitcoin’s inability to respond flexibly to economic crises. However, for many, Bitcoin’s apolitical nature and fixed supply are seen as protections against the often-detrimental impacts of policy-driven inflation.

This exploration of money’s history and the theoretical underpinnings of Bitcoin as a monetary asset sets the stage for deeper discussions on its practical implications in modern economics and individual portfolio management. By understanding where Bitcoin fits within the historical context of what humans use as money, investors and users can better appreciate its potential role in reshaping financial interactions on a global scale.

Gold vs. Bitcoin: A Comparative Analysis

The comparison between gold and Bitcoin illuminates the shift from traditional to digital assets in the financial world. Gold has historically been the standard for monetary assets due to its physical properties: it is durable, and its scarcity has always been seen as a hedge against inflation. However, Bitcoin emerges as a compelling modern alternative, leveraging technology to address some of the limitations inherent in physical gold.

Inherent Features of Gold

Gold’s success as a monetary asset has been driven by its inherent value and historical significance within global economies. It is widely recognised and has been used as a store of value and medium of exchange for thousands of years. Its physical nature means it is not susceptible to problems that might affect digital assets, such as cyber-attacks or technological failures. However, gold does have limitations, particularly its physicality, which restricts ease of transfer and its divisibility.

Advantages of Bitcoin Over Gold

Bitcoin offers several advantages over gold that align with the needs of a modern economy:

- Portability and Divisibility: Bitcoin can be transferred across the globe almost instantly and divided into much smaller units than gold without loss of value, catering to micro-transactions.

- Scarcity and Verifiability: Bitcoin’s supply is capped at 21 million coins, and every transaction is verifiable through the blockchain network, ensuring transparency and trust.

- Decentralisation: Unlike gold, which often requires storage and can be subject to government confiscation, Bitcoin operates on a decentralised network, reducing the need for intermediaries and enhancing security for its holders.

Bitcoin’s Blockchain Technology as a Game Changer

The backbone of Bitcoin is blockchain technology, which provides a decentralised ledger for all transactions. This technology ensures that Bitcoin is not only a theoretical digital asset but one that offers real-world applications in avoiding fraud, providing transparency, and reducing the costs associated with transactions. Unlike the physical trading of gold, which can be cumbersome and costly, Bitcoin transactions can be completed almost instantaneously at a fraction of the cost, providing a modern solution for investors and users alike.

Bitcoin’s Role in Modern Financial Systems

As Bitcoin continues to gain acceptance, its role as a modern monetary asset becomes more established. It challenges traditional financial systems by offering an alternative that is not only based on technological innovation but also aligns with a growing preference for digital solutions. For investors and consumers looking for an alternative to gold, Bitcoin presents a viable option that combines historical investment principles with the benefits of modern technology.

In conclusion, while gold has served as a reliable store of value for centuries, Bitcoin represents the next evolution of monetary assets. Its integration into investment portfolios is increasingly viewed not just as an alternative, but as a necessary diversification strategy that reflects the changing dynamics of global financial markets. As we continue to explore Bitcoin’s potential, it becomes clear that its role extends beyond just a new investment option—it is a redefinition of what constitutes money in the digital age.

Bitcoin in Modern Portfolio Allocation

Incorporating Bitcoin into modern investment portfolios represents a paradigm shift, acknowledging its potential not just as a speculative asset but as a strategic component for diversified asset management. Understanding how to integrate Bitcoin effectively involves assessing its volatility and the broader implications of its market behaviour.

Volatility and Portfolio Diversification

Bitcoin is renowned for its volatility, which can be intimidating for investors accustomed to more stable assets like stocks and bonds. However, volatility is not necessarily a drawback if managed correctly within the broader context of an investment portfolio. By allocating a small percentage of the portfolio to Bitcoin, investors can potentially enhance overall returns without proportionately increasing their risk exposure.

The Case for Bitcoin in Diversified Portfolios

Recent studies and financial analyses show that adding a small allocation of Bitcoin to a diversified portfolio can significantly enhance performance. For instance, introducing a 5% allocation to Bitcoin alongside traditional assets can boost total returns substantially while only marginally increasing the portfolio’s maximum drawdown. This scenario demonstrates Bitcoin’s potential to increase investment growth due to its low correlation with other asset classes, providing beneficial diversification effects.

Risk Management and Strategic Allocation

Effective risk management is crucial when incorporating Bitcoin into investment portfolios. Investors must consider their risk tolerance, investment horizon, and the overall investment strategy. Regular rebalancing of the portfolio to maintain a set allocation towards Bitcoin can help manage risk and harness its potential for high returns.

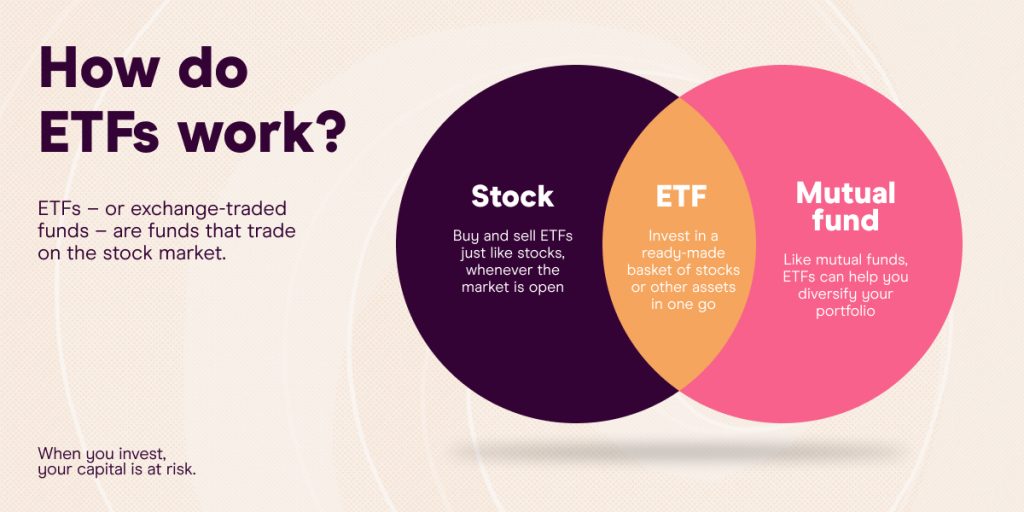

Adopting a Forward-Thinking Investment Approach

The advent of Bitcoin ETFs has simplified the process of including Bitcoin in diversified portfolios. These ETFs provide investors with exposure to Bitcoin’s potential upsides while mitigating risks associated with direct cryptocurrency holdings, such as security concerns and regulatory uncertainty. They represent a significant step forward in making Bitcoin a more accessible and manageable asset for mainstream investors.

Looking to the Future: Bitcoin’s Role in Modern Portfolios

As the financial landscape evolves, so too does the role of Bitcoin within it. With growing recognition of its benefits as part of a diversified investment strategy, Bitcoin is poised to become a more prevalent feature in the portfolios of forward-thinking investors. The key to success with Bitcoin lies in understanding its properties thoroughly, recognising the strategic value it can add in terms of diversification and return enhancement, and implementing it in a way that aligns with individual investment goals and risk profiles.

For those looking to explore the dynamic potential of Bitcoin in their investment strategies, it’s advisable to consult with financial experts who can provide insights and guidance tailored to specific needs. As we continue to navigate the complexities of global markets, the inclusion of Bitcoin and other digital assets will likely play an increasingly significant role in shaping the future of investment portfolios.

The Future of Bitcoin and Digital Assets

As we contemplate the evolving landscape of investment and the burgeoning role of digital assets like Bitcoin, it’s essential to project the potential future paths these technologies could take and their implications for the global economy and individual investors.

Bitcoin’s Maturing Market

Bitcoin’s journey from a niche digital curiosity to a recognised financial asset suggests a trajectory that could see it becoming an integral part of more investment portfolios. As institutional investors and major financial players begin to show increased interest, the market is likely to see greater liquidity and possibly reduced volatility over time. This maturation could help stabilise Bitcoin’s price fluctuations, making it more appealing to conservative investors.

Technological Enhancements and Innovations

Bitcoin technology continues to evolve. Innovations such as the development of the Lightning Network aim to solve scalability issues and reduce transaction costs, making Bitcoin more efficient as a transactional currency beyond just a store of value. These technological advancements could expand Bitcoin’s use cases and increase its adoption rate globally.

Regulatory Environment and Acceptance

The regulatory landscape for Bitcoin is still in its formative stages, with significant variations between countries. As regulations become more defined and possibly harmonised across borders, Bitcoin could gain further legitimacy and trust among traditional investors. This would also help mitigate one of the major risks associated with investing in Bitcoin—the uncertainty of legal and regulatory positions.

Integration into Traditional Financial Systems

The integration of Bitcoin into traditional financial systems through products like Bitcoin ETFs signifies a critical step towards its mainstream acceptance. These financial instruments not only make it easier for ordinary investors to gain exposure to Bitcoin without dealing with the technicalities of crypto wallets and exchanges but also add a layer of regulatory oversight that can provide additional security for investors.

Long-Term Implications for Portfolio Diversification

Looking ahead, Bitcoin’s distinct characteristics—such as its limited supply and independence from traditional economic systems—might make it an increasingly attractive option for portfolio diversification. Especially in scenarios where traditional assets like stocks and bonds are underperforming, Bitcoin could offer an uncorrelated hedge or counterbalance.

Conclusion: Embracing Bitcoin in the Financial Landscape

As we wrap up our exploration of Bitcoin’s role in modern portfolio management, it’s clear that Bitcoin and digital assets are more than just speculative instruments; they represent a significant shift in how we think about money, investments, and the structure of the financial markets.

Bitcoin’s Broadening Appeal

Bitcoin’s potential extends beyond its early adopter phase into a period where it can significantly impact diverse investment strategies. As Bitcoin becomes more integrated into the financial ecosystem, its role as both a hedge and a growth asset becomes more pronounced. Investors who once viewed digital assets as too volatile or speculative are now considering them as essential components of a well-rounded portfolio.

The Role of Education and Professional Guidance

Navigating the complexities of Bitcoin investment requires more than just understanding its market behaviour; it involves a comprehensive appreciation of its technological foundation and potential economic impact. Education plays a critical role in this, as does the guidance provided by financial advisors who are well-versed in both traditional and digital asset markets. For investors, partnering with advisors who can offer insights into how Bitcoin fits into broader financial goals is invaluable.

Future Outlook and Adoption

Looking forward, the trajectory of Bitcoin will likely be influenced by several factors, including technological advancements, regulatory changes, and its adoption by institutional investors. As more financial institutions begin to offer Bitcoin-related products and services, we can expect its acceptance and integration into mainstream finance to increase, potentially stabilising its price and reducing volatility.

The Importance of Strategic Allocation

For those considering adding Bitcoin to their investment portfolios, strategic allocation is key. Understanding how much to invest, when to adjust holdings, and how to balance Bitcoin with other assets are crucial decisions that should be made with professional input. The goal is to integrate it in a way that aligns with individual risk tolerances and investment objectives.

Invitation to Explore Bitcoin with Brigantia

At Brigantia, we are committed to providing our clients with cutting-edge financial advice that includes the latest developments in digital assets like Bitcoin. We believe in the transformative potential of Bitcoin and are here to help our clients understand and leverage this dynamic asset for their investment success.

We invite you to contact us for a comprehensive discussion on how Bitcoin can enhance your investment strategy. Whether you’re new to digital assets or looking to optimise an existing investment, Brigantia is here to guide you through the evolving landscape of finance with expertise and insight.

In conclusion, Bitcoin represents both a challenge and an opportunity in modern finance. By staying informed, seeking professional guidance, and carefully considering your investment strategy, you can potentially harness the benefits of Bitcoin while mitigating its risks. As the financial world continues to evolve, so too should our strategies for wealth building and preservation.

Let Brigantia help you navigate this promising yet complex asset class.