Financial Advice is a Choice!

I was a financial advisor. There, I said it, I admit it. I sometimes feel by admitting to it I am on the journey to healing. There should be a support group for all the sad and lonely people who have this nightmare in their closet where we meet every month and start with an affirmation

“I have not given any financial advice in the last month.”

To which everyone claps and says well done.

Every year in Bangkok there is the fresh intake of young bright eyed and bushy tailed Financial Advisors ‘sweating’ in their new stripy suits and golden business cards and they soon start to feel quite isolated when the other business networkers can see them coming and avoid them.

The new recruits wonder what they have done wrong. A quick sniff of armpits and breath test in the loos do not reveal any misgivings.

They continue for a few more weeks but the stress of 100 cold calls a day to the chamber of commerce directories and some ill bought-in databases and 99 people a day who actually answer, hang up or just give them an earful of abuse over the phone, kills any resolve they had left after their telemarketer who was promised to them is conspicuous in their absence.

It is an all too familiar pattern when they turn tail back to their home countries earning nothing in their time, except a bad taste of the expat financial industry.

Why do people avoid them?

Cold Calling

Well one argument is that Financial advice should not start over the phone, and you could argue the same could be said in any business. Yet how many billions of dollars of good legit business started with a cold call? Yes, it does not work at any effective level than it did perhaps in the 1980-90’s but if you have nowhere to start from the phone is always there.

If one in 500 calls gets you a sale, well at the ticket price it’s still not bad. There will always be some who are impervious to the stigma of cold calls, Illegal? probably! Annoying? definitely! Effective? -arguably so.

I never made cold calls by the way I used Social Media

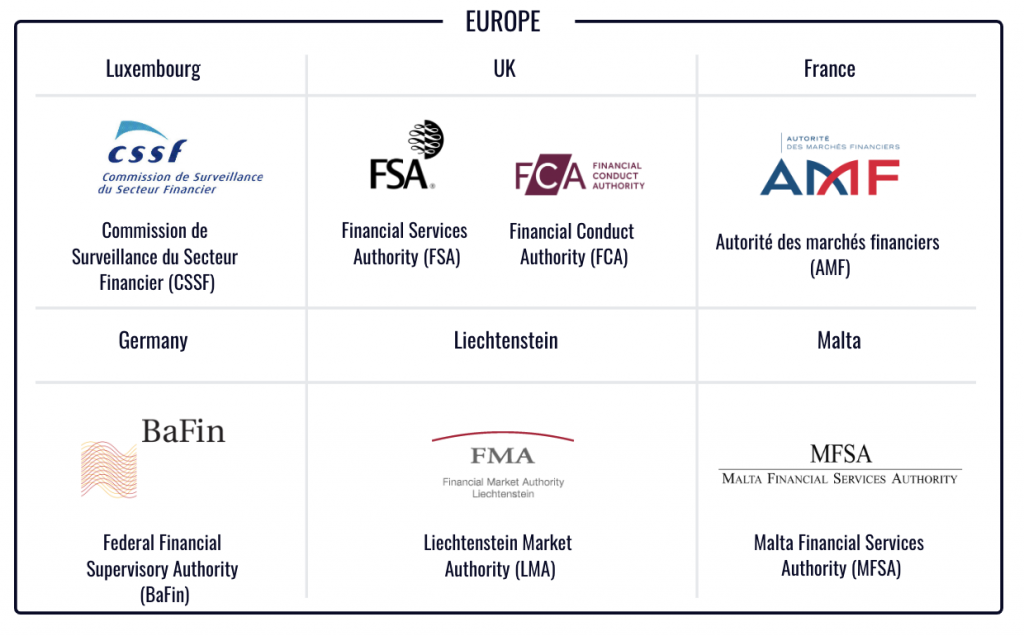

Another argument is that many are unregulated.

This is very misunderstood and an excuse not to get a financial checkup.

Over 16 years I have spoken to many very experienced people in Southeast Asia who have been Bank Managers, and many who were CEO’s of Blue Chip financial Institutions in Europe and The United States, who tell me full regulation is nigh on impossible no matter how hard they try.

In Asia they want Asians dispatching advice and selling ‘off the peg’ financial products, not some wide boy from London or Liverpool! So, they make regulation so difficult it is virtual impossible to find anyone who with a work permit who is fully regulated.

Think about it like this, if you have a longtime friend with a 50-million-baht beach view penthouse and an amazing lifestyle and you live in a studio condo for 5k THB a month and one day, over a beer he says;

‘Hey Buddy I can get you the same lifestyle no issues’

Or your colleague at work who has just had a statement from his big insurance company for a plan that has turned over 30% this year, are you going to ignore them because they are unregulated?

I think not. Being regulated does not mean they or their advisors don’t know about finance! It is just an excuse I have heard from many an expat.

I am not saying take advice from just anyone. Sure, regulation has its place and protects consumers somewhat, but I could also name many financial products that have been sold by ‘regulated advisors’ over the last 2 decades that go belly up! At the end of the day Regulation protects the financial houses and their advisors as much as it tries to protect the consumer.

I would say do your own research. Don’t leave all your decisions based on whether your I.F.A. is approved by a regulatory agency or not. Try to remember regulatory agencies are more often created by the very people within the financial industry who want a badge to get over bias and make sales easier.

Find financially secure people, or people with means that have a financial advisor and ask who they use. How much risk you put on that is up to your ethical and moral compass!

Ex Washing Machine Sales people

Another reason people dislike I.F.A’.s is because many of them have little to no experience in finance and are just sales people from various backgrounds. Whilst this is true of many out there right now, one must be fair and say they are just affiliates for the big financial houses, trained to sell their products and that is all you are buying.

The most important thing I said when I was selling finance was:

“Oh, your money goes nowhere near my bank account, it is sent directly to the financial houses that you choose. If anyone selling finance of any kind asks you to send cash to their bank, drink your coffee, make your excuses and flee the premises! If you choose a plan the financial house pays me, not you”

I helped a few people make choices, and that is all I was trained to do. If there was anything I did not understand I asked for help from the professionals, the Bank Managers and the Principals of the agencies with whom I worked, who really knew what was happening and everything was signed off by them, and again at the last stage by the financial houses themselves.

Just as many plan applications get rejected as accepted by the last signature at the top anyway, so I slept just fine each night knowing I got the same good advice I would take myself!

If you prefer to be advised by a person with a good background and acumen in the financial industry, then you need to ask for the person’s CV and experience. It is just a question away, and Google can always hep you there. Also get referrals. Trust your intuition as much as the regulations.

Another starker way of looking at it is you are looking for a new television and you ask the drunk in the street where the TV shop is, and he sends you to the right place, are you going to just walk straight past the shop because the messenger was scruffy?

Most Financial people hate their title because no one in finance is an expert. There are experienced people who temper time with sensible investments and make steady progress which is how most people have pensions. They understand risk and they must balance your risk appetite with their experience and advise you thus.

Again I harp on about your choice because it is exactly that. Our Financial advisor may be begging you not to gamble all your equities on a Crypto hunch , BUT, if you were adamant, they will cover themselves, get you to sign all sorts of paperwork that says you went against their advice and you can do what you bloody well want with your money!.

After I met my first Financial advisor 15 years ago, and after I worked in the industry myself, I would never ever miss the opportunity to meet one, even if they cold called me because you never know what you can learn. They know the latest news in the industry and what’s hot and what’s not, and they always buy coffee for you and at the end of the day it is your choice to choose what they present to you. Where is the harm in that?